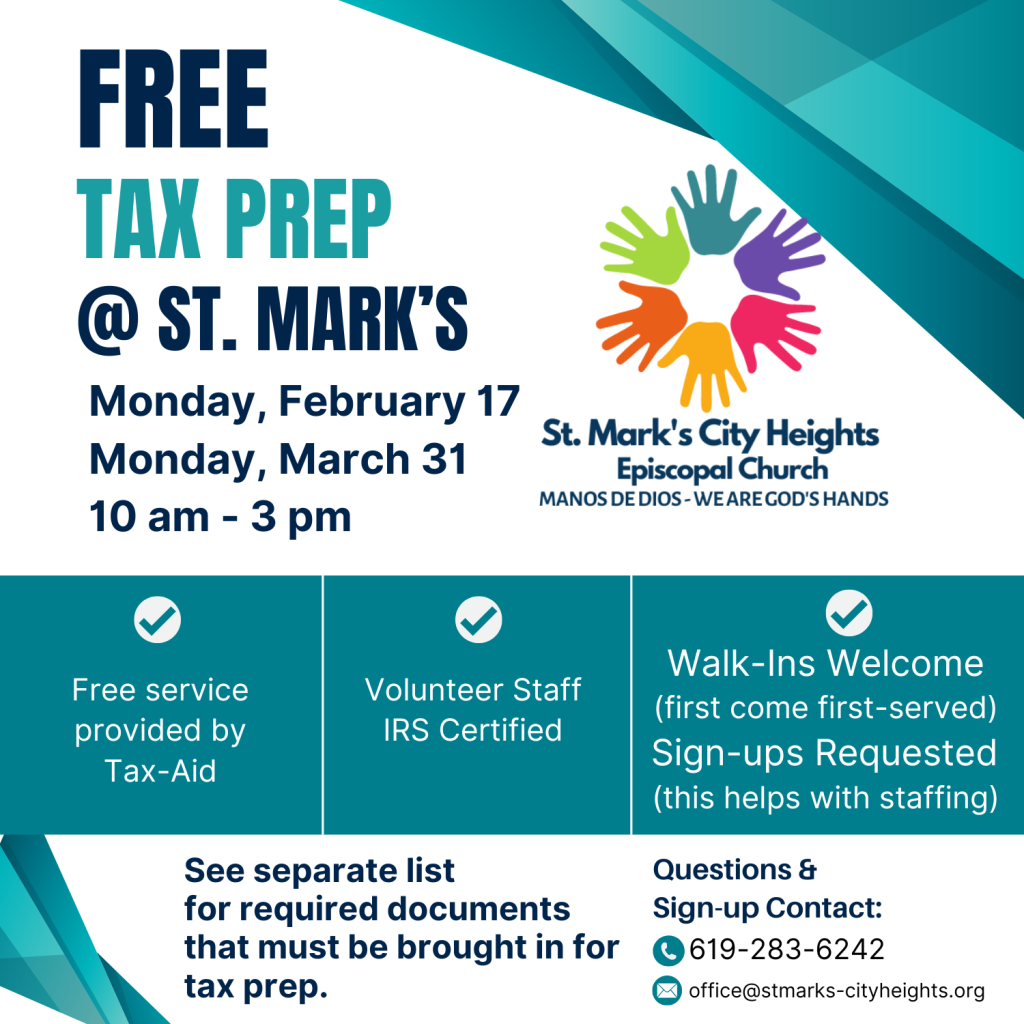

Free Tax Prep | IRS Certified Tax preparers from Tax Aid will be at St. Mark’s Monday, February 17 & Monday March 31, 10 am – 3 pm to help you prepare your tax return free of charge. Walk-ins welcome, however to assure proper staffing sign ups are requested. Contact: office@stmarks-cityheights.org to sign up. IMPORTANT: please look at the required list of items below.

What taxpayers must bring: (I have attached a poster in English and Spanish with this information)

❒ Government-issued photo ID for the taxpayer(s) on the return

❒ Social Security cards or ITIN documentation for everyone on the return (spouses, children, dependents)

❒ Copy of prior two years’ tax returns (helpful but not usually absolutely required)

❒ All Income documents & records for wages, interest, dividends, capital gains/losses, unemployment compensation, pensions and other retirement income, Social Security benefits and self-employment (like Uber & Doordash drivers, handymen and single crafts people who are not provided a W-2)

❒ Brokerage statements – sale of stocks or bonds

❒ Healthcare – Forms 1095-A if have marketplace insurance (Covered California)

❒ Mortgage interest, medical/dental expenses, charitable donations, sales, income or property taxes

❒ Records of federal and state income taxes paid

❒ Educational expenses – Form 1098-T, student’s detailed financial school account; or other education expenses

❒ Checking or savings account info (printed or actual copy) for direct deposit of refund or direct debit of balance due

❒ IRS letters showing Economic Impact Payments (EIPs) and Advanced Child Tax Credit payments received

❒ Any other recent IRS or state tax department correspondence you received